What is direct debit?

Overall, direct debit services are very convenient and can save you a lot of time and money. They can also help you keep track of your finances and budget better. However, it is important to remember that they are not without their risks. Be sure to do your research and understand all the terms and conditions before signing up for any direct debit service.

How do direct debit services work?

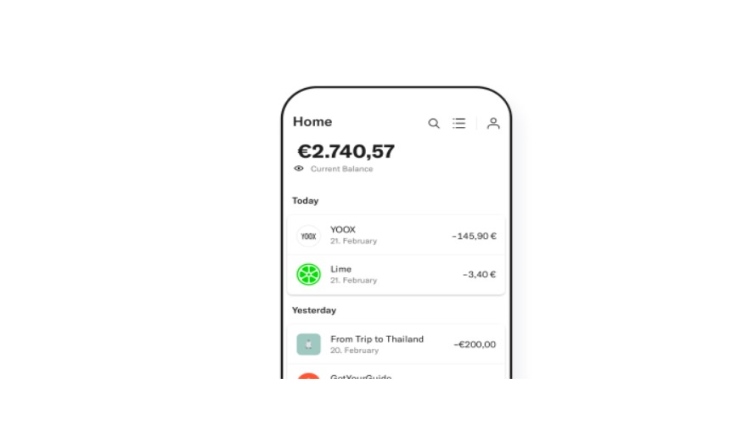

You can set up a direct debit services Australia by providing your bank account details to the company or person you want to pay. You will need to give them your permission to debit your account, and you can usually do this online. Once you’ve set up a direct debit, the payments will be automatically deducted from your account on the due date. You don’t need to worry about remembering to make the payment, or paying any late fees.

A direct debit is an instruction from a customer to their bank or building society. It authorizes the organization to take money from their account at regular intervals. The customer must have given the organization permission to set up the direct debit and they must have been given advance notice of the amount and date of each payment.

The service is designed for customers who want to make regular payments, for example monthly subscriptions or utility bills. It is also used by businesses as a way of collecting payments from customers, such as Council Tax.

Each time a payment is due, the amount is transferred from the customer’s account to the payee’s account on an agreed date. The payee does not need to give prior notice to the customer that they will be taking a payment – this is arranged in advance when setting up the direct debit instruction.

If there are insufficient funds in the account to cover a payment, most banks and building societies will still pay it but may charge for doing so. This could result in additional fees being incurred such as bank charges or interest on overdue amounts owed.

It’s important to note that if you have authorized a company to collect payments from your account via

What are the benefits of using direct debit services?

If you’re like most people, you probably have a lot of bills to pay each month. Between rent, utilities, credit card payments and other expenses, it can be tough to keep track of everything. This is where direct debit services can be extremely helpful.

With direct debit, you can automatically have your bills paid on time each month without having to remember to do it yourself. This can save you a lot of stress and late fees. Additionally, many companies offer discounts for customers who use direct debit. So not only will you save money on late fees, but you may also get a lower rate on your bill.

Overall, using direct debit services is a great way to stay organized and save money. If you’re not already using them, we highly recommend giving them a try!

Are there any risks associated with using direct debit services?

There are a few risks associated with using direct debit services. The main risk is that if you have insufficient funds in your account to cover the amount of the direct debit, your bank may charge you a fee. Additionally, if you cancel a direct debit without first informing the company that they are no longer authorized to take payments from your account, you may be charged a cancellation fee. Finally, if you set up a direct debit for an amount that is more than what is actually owed, the company may charge you an overpayment fee.

How can I ensure that my direct debits are set up correctly?

If you are unsure about whether or not your direct debits are set up correctly, there are a few steps you can take to ensure that they are. First, check with your bank to see if they offer any guidance on setting up direct debits. Many banks will have online resources that can help you through the process. Additionally, make sure to keep track of when each of your direct debits is due to be paid. This will help you ensure that the payments are being made on time and as scheduled. Finally, if you have any questions or concerns about your direct debits, don’t hesitate to reach out to your bank for assistance.